When Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) first announced it was acquiring Fitbit (NYSE:FIT), I was excited to look at the deal. But it did not look good to me because of the small spread, only 1.9%, between the offer and Fitbit's share price. I also viewed it as a merger that could attract a lot of negative media attention because of both companies' reputation for data collection. That fear wasn't for nothing because there is a lot of attention for this deal and its privacy aspect.

- Warning! GuruFocus has detected 5 Warning Signs with GOOG. Click here to check it out.

- GOOG 30-Year Financial Data

- The intrinsic value of GOOG

- Peter Lynch Chart of GOOG

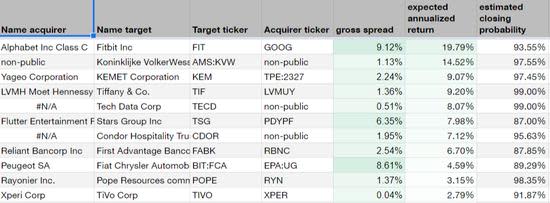

Interestingly, because of that, the spread has increased to a very attractive gross spread of 9.12%. The table below shows part of my dashboard, where I track most merger and acquisition deals that are ongoing, if you look at expected annualized return that's close to 20%.

The expected annualized return is different from straight-up annualizing the spread. The difference is that the expected return includes times that the deal failed. It is an average expected return. The image above also shows the closing probability, which I have put at 93%.

The primary concern the market has for this deal is that the Department of Justice is going to block it. These antitrust fears are also being played up in the media. I do agree there's a risk as regulators are scrutinizing this deal, according to Reuters.

However, this is clearly reflected in the near 20% spread. This indicates an annualized return is in the neighborhood of 24%. I estimate it will take about 150 days to close the agreement due to all the complexity. The return profile looks very attractive compared to other deals out there, with only a few exceptions.

The risk is also somewhat mitigated. Alphabet needs to pay a $250 million fee to Fitbit if the deal were to fall through. It will also pay the fee if antitrust regulators break it up.

By my estimate, the probability the deal will close is nearly 95%. When I decrease the closing probability to 90%, the annualized expected return remains at 20%.

It is overly careful to lower the closing probability further. Even though regulators are often interviewed, there is no solid precedent for a judge to block this deal. There are data privacy issues, but I believe these will be ultimately overcome. I think the deal is very likely to close. The big risk is that it gets dragged out for a very long time. To get some perspective, Fitbit is a tiny company worth only a few billion dollars. It has some juicy data, but it not a limitless data goldmine. If you look at deals that were allowed to close, it becomes obvious why it would be very surprising if this one gets shut down: Microsoft (MSFT) acquired LinkedIn, Facebook (FB) acquired WhatsApp and Instagram and Open Text (OTEX) bought Carbonite.

Maybe the deal gets blocked, but that would be a major change in M&A policy. Why block this small deal? It can happen, but the odds are against it.

Another risk is a large drawdown if the deal were to break. Alphabet and Facebook had a bidding war that drove up the price hard. But if Alphabet is not allowed to buy the company, surely Facebook isn't either. Before the bidding war, Fitbit was priced at $3. That's 50% downside. But Fitbit also has $500 million in cash. A deal break would increase that by another $250 million. That's a big cushion. Therefore, I'm not sure the company will fall all that much in price if the deal breaks, but assume its 20% to be conservative.

The expected value at nearly 20% looks great to me here. The worst-case scenario is likely a lengthy approval process. If the deal gets drawn out to a year or longer, the internal rate of return suffers tremendously.

Disclosure: No position.

Read more here:

- Rhupal Bhansali of Ariel Investments: Outlook Includes Earnings Recession for 2020

- Dodge & Cox Is Well Positioned for When Value Has Its Resurgence

- Howard Marks Gambles Like He Invests; Cautiously

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

- Warning! GuruFocus has detected 5 Warning Signs with GOOG. Click here to check it out.

- GOOG 30-Year Financial Data

- The intrinsic value of GOOG

- Peter Lynch Chart of GOOG

"like this" - Google News

January 20, 2020 at 04:54AM

https://ift.tt/2txofyp

Why I Like the Alphabet, Fitbit Deal - Yahoo Finance

"like this" - Google News

https://ift.tt/2MWhj4t

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

No comments:

Post a Comment