Eric Broder Van Dyke/iStock Editorial via Getty Images

Background

Disney (NYSE:DIS) is a stock that needs no introduction. Almost everyone has been touched by one of its beloved characters, seen the joy on a child's face visiting Disney World, or debated about the Marvel universe.

However, Disney looks much different today than it has in the past. The company has expanded its service offering to include many different networks and brands. Quantity of content has been Disney's only care in recent years. However, that is changing as they shift their focus towards quality. In order to create better content, the company's objectives are: (1) revitalizing Disney+, (2) introducing various pricing tiers, (3) increasing advertisement revenue, and (4) simplifying their offerings.

The Objective of this Article

Many Seeking Alpha authors have done an excellent job presenting issues with Disney's streaming services with ideas on what has gone wrong and how to fix it. Rather than rehash the same topic, I want to go in depth on Disney's financials and ultimately, the valuation based on the latest earnings report.

Overall Assessment of the Financials

The biggest issues are the company's deteriorating gross margins, high leverage, and high interest payments.

Gross Margins

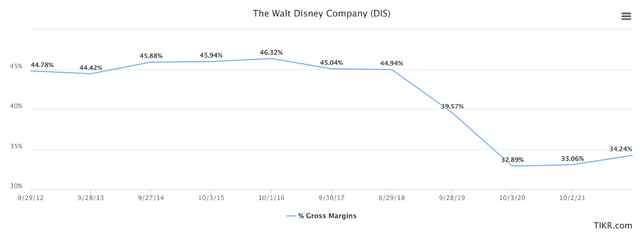

Disney's Gross Margins (TIKR)

Disney's revenue has grown, but its gross margins have compressed, which is unusual given that the company has been expanding into streaming services, the point and benefit of which is typically high margins. It would be easy to say viewers are uninterested in Disney's content so the company cannot generate enough revenue to recoup production costs, but I am unsure if it is that simple. For example, Disney had 4 out of the top 10 box offices hits in 2022. Perhaps the costs are too high even with the outstanding sales.

Long-Term Debt

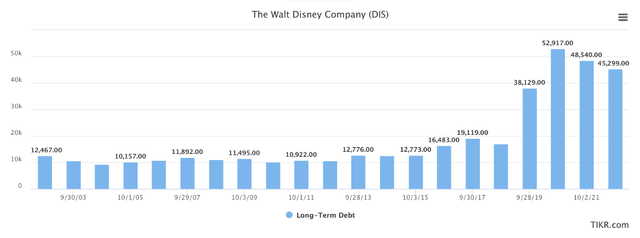

Disney's Long-Term Debt (TIKR)

Another issue is Disney's massive debt load. Management has changed the nature of Disney's business in recent years by acquiring numerous businesses, many of which are completely unrelated to one another. In order to fund this expansion, management has almost tripled the company's debt load from its historical average.

This is problematic for a couple of reasons, as currently:

- The company's free cash flows are significantly less than normal.

- Interest rates are rising.

Both of these factors make the debt on the balance sheet more cumbersome.

Interest Expense and Cash Flow

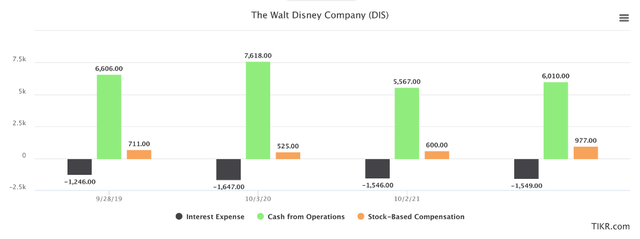

Disney's Interest Expense and CFFO (TIKR)

Given the enormity of the debt, the company has large interest payments, which unfortunately, make up a large percentage of its cash flow from operations. One important adjustment few analysts make is accounting for the illusionary effects of stock-based compensation.

Under GAAP rules, SBC is classified as a non-cash expense, which allows companies to actually add SBC back into its cash flow calculation. This deceivingly inflates that number as SBC is a cash expense as it represents management's future claim on earnings and thus, must be subtracted from cash flow from operations.

When accounting for SBC, the interest expense to CFFO ratio was 31% in the last two years. Out of all the effort and costs Disney endures to generate a profit, 1/3 of it vanishes just in order to make its interest payments. Equally as important, the average CAPX over the past four years was $3.6 billion, which represents 72% of cash flow from operations.

When we add up the money Disney spends on interest (31%) and CAPX (72%) alone, there is nothing left over; it equals 103%, which exceeds operating cash flow. This presents a challenge because the question becomes, if a company doesn't have the money to grow internally (because it's all being spent on debt servicing and maintenance), then where does it get the money to grow? It has to borrow more or issue new stock.

Note: This is why, by the way, the company cut its dividend. It becomes clear when we analyze the numbers that there is no actual free cash flow to pay a dividend. There is free cash flow on the books, but that is an accounting measurement of FCF, not a cash measurement. Below we can clearly see the deterioration in Disney's accounting based FCF.

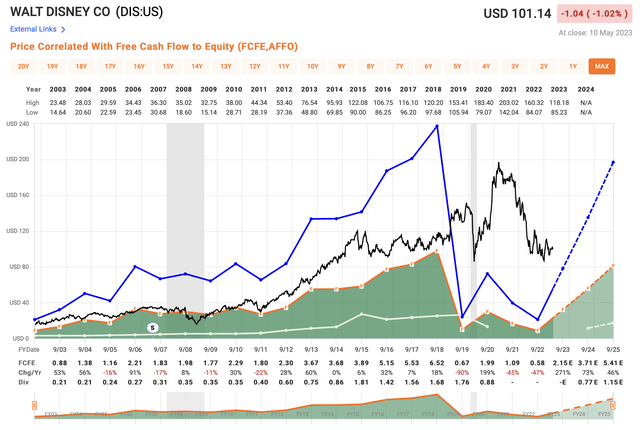

Free Cash Flow (FastGraphs)

Q2 2023 Results

If I had to summarize the quarter in one sentence, it would be this:

Disney is moving in the right direction, particularly in its DTC channel, but the numbers do not reflect improvement yet because the change of course has just started.

The Story

Disney has struggled with its DTC channel as that segment's costs are compressing margins, which is shrinking the bottom line. This is an interesting case because at a glance, Disney's streaming services should be excelling as they own super-mega-franchises and iconic characters. Yet, the company lost four million (2%) of Disney+ subscribers in the quarter and plans to record up to $1.8 billion in impairment charges next quarter for the removal of unpopular content. This is literally a huge write off (expense) for saying, "we paid a fortune to make a lot of shows that no one watched."

There are lots of theories for why Disney's streaming services have struggled, and like I said earlier, I want to focus on the financials.

The Numbers

From a data perspective, the latest quarter confirmed more of the same issues and did not show significant improvement in any of the previously discussed categories: gross margins, leverage, interest/CFFO. Specifically…

- Gross margins came in at 33%

- Long-term debt was $45 billion

- Interest expense as a percentage of cash flows was 30%

All three data points are identical to Disney's lower than expected performance in recent years. Had the company reached an inflection point this quarter, one could say the future looks better, but as of now, it remains unchanged. The structural issues plaguing Disney in these categories have been largely unabated.

Finally, the company generated an EPS of $0.93 in the quarter, which roughly translates to a fair value (15 P/E) of about $55 per share. With this in mind, let's move on to the next section…

Valuation

I will provide two methods of valuation - first, my own discounted cash flow and second, FastGraphs earnings valuation.

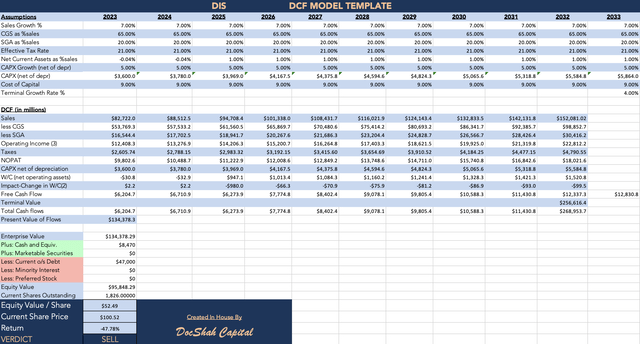

DocShah's DCF

Below is my discounted cash flow model for Disney. There are numerous assumptions made and it is important to note no two investors will get the same valuation. I assume 7% growth per year and 4% in perpetuity to reflect higher inflation. Costs and CAPX were based on recent historical averages. The tax rate is fixed at 21%. The CAPX growth is probably too lenient, but I gave Disney the benefit of the doubt. The WACC is 9% and was calculated using the CAPM model.

DIS DCF 2023 (Author, DocShah Capital)

Disney's fair value is $52.49 or somewhere near. This represents significant downside to the company's current stock price. However, Disney is a legacy brand and almost always trades at a premium to its fair value. Specifically, the normal P/E for Disney is 22 versus a typical fair value P/E of 15. In other words, Disney almost always trades at a 50% premium to its fair value, meaning the stock price in this case would be worth around $77 per share. Therefore, $77 per share is a more accurate depiction of the company's fair market value and as a result, the downside risk is likely closer to (24%) from current levels.

Note: Keep in mind part of the reason the market graced Disney with a 50% premium was the company's dividend, which now ceases to exist. This is very important to consider when choosing which future P/E is appropriate to use to value Disney moving forward.

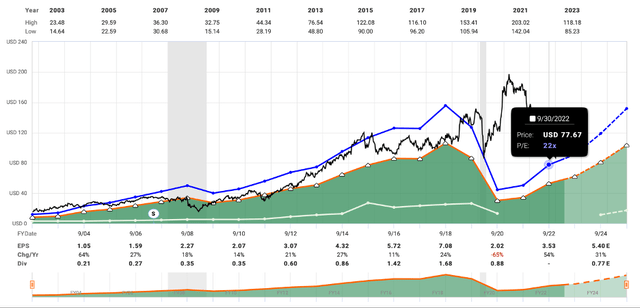

FastGraphs

Disney's Earnings Graph (FastGraphs)

FastGraphs informs us that Disney's normal P/E stock price is about $77 and its fair value P/E is about $52 (the white triangle directly underneath the highlighted blue dot). Both these estimates exactly corroborate with my discounted cash flow model.

What Would Make Disney a Buy?

Below are four improvements which could turn Disney into a buy.

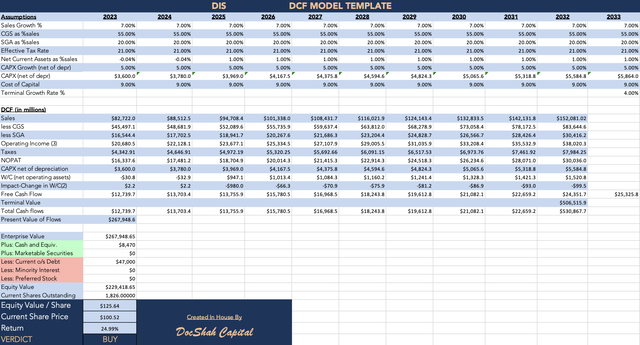

Improved margins - In each of the past few years, Disney's gross margins have dropped around 150 basis points over the historical average. This has caused significant erosion to the bottom line. If the company's gross margins get back on track with historical averages of 45%, the stock will be worth over $125 per share.

Disney's Valuation with 45% Gross Margins (Author, DocShah Capital)

Reduced debt - The amount being paid in interest each year is eating into cash flows which could be used for better purposes. Instead of taking on debt in order to continually acquire more companies, Disney would be better off biting the bullet and admitting this strategy was a mistake. If they do, they can spend the upcoming years reducing debt and have more future cash flows to fund profitable investments.

Less acquisitions - Speaking of acquisitions, Disney could use less of them and more focus on producing great content, theme park upgrades, and overall expanding on the great brands/characters they already own.

Shareholder friendly management - When possible, if Disney places more focus on returning capital to the shareholders by reinstating its dividend and a stock buyback program, then its stock would be much more rewarding, appealing, and enticing to investors.

Note: In point four, we are far removed from any sensible stock buybacks. Only when appropriate should this be considered.

Go Woke Go Broke?

Lastly, I want to discuss the idea that many commentators bring up and it revolves around the question, "has Disney become too ideological?" Many Americans complain that Disney's forced interjection of politics, race, gender, sexuality, etc., have turned away families and traditional viewers to a point where those people (who make up a majority of Disney's audience) are not interested in viewing that type of content any longer.

Disney (and other forms of non-ideological content) is meant to be an escape from the real world. Disney's movies allow everyday people to get lost in adventure and a world filled with organic [keyword] characters. Forcing any sort of ideology (political, religious, sexual) unnaturally into programs (which are not intended for such polarizing viewpoints), is a risky decision that can backfire.

Takeaway

Management's quest to turn Disney into a conglomerate has destroyed a lot of shareholder value over the past few years. Margins, interest, debt, and stock-based compensation are all weighing on the company's profitability. The valuation is quite rich and if markets were rational, I would expect the stock to fall anywhere in the range of (25-50%). However, if the company starts to show improvements in the problem areas, such as achieving previous margins, bringing back its dividend, and reducing leverage, then the stock could be a buy. Until then, I rate Disney as a sell.

"like this" - Google News

May 11, 2023 at 08:22PM

https://ift.tt/pqT5PRa

Disney: I Wish I Could Like This Stock (NYSE:DIS) - Seeking Alpha

"like this" - Google News

https://ift.tt/ym8kplC

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

No comments:

Post a Comment