olm26250

High yield, high growth opportunities are quite rare. That is because if Mr. Market thinks a stock is likely to grow its earnings rapidly for many years to come, it typically assigns it a lofty valuation multiple. Moreover, many high growth stocks typically retain the vast majority of their earnings in order to reinvest them aggressively into their business to maximize their growth potential. These two factors combine to relegate high growth stocks into the very low to no yield category. This is why at High Yield Investor, we rarely buy stocks from high growth sectors such as disruptive technology (ARKK).

The best investors can typically do to combine the two is to buy a fund such as the Schwab U.S. Dividend Equity ETF (SCHD), which gives investors a 3.54% dividend yield at present alongside average annualized dividend growth of ~10%. While this is a pretty attractive investment proposition and has delivered attractive long-term wealth and passive income compounding for investors, a 3.5% yield at the moment is hardly high yield.

However, right now - thanks to the market's uncertainty about where interest rates and political winds are headed - investors can buy several high yield, high growth stocks that are backed by very stable, defensive cash flows. Given that this opportunity could vanish rapidly, we are buying these stocks hand-over-fist while we still can:

High-Yield High-Growth Stock #1: NextEra Energy Partners Stock (NEP)

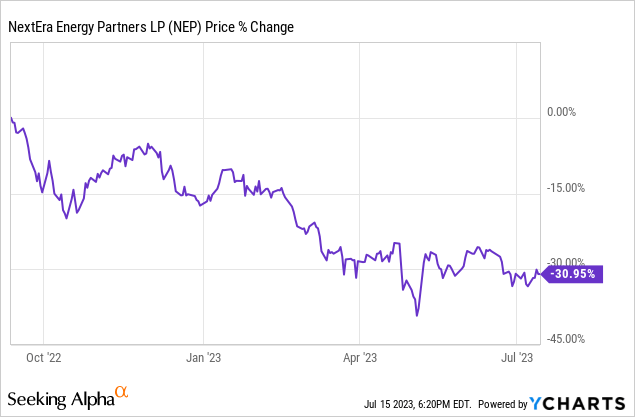

NEP stock has taken a beating over the past 10 months as concerns over rising interest rates and how management would navigate its substantial upcoming convertible equity portfolio financings ("CEPF") obligations have weighed heavily on the stock:

As a result, the NTM distribution yield has soared to 6.1%, up significantly from its five year average yield of 4.26%. Moreover, management has reaffirmed its commitment to achieving a 12%+ distribution per unit CAGR through 2026 thanks to its recapitalization and portfolio simplification plan:

- Sell its natural gas pipeline assets to generate proceeds to fully fund its upcoming CEFP obligations and provide equity capital alongside its retained cash flows to fund its growth projects and acquisitions. It therefore will not have to raise common equity if it does not want to (though it likely will if the stock price is attractive enough) and will still be able to achieve its growth objectives.

- Its IDR fees to its parent NextEra Energy (NEE) have been suspended effective immediately through 2026 (and potentially beyond) in order to offset the cash flows that will be lost from selling its pipeline assets.

When combined with its well-diversified portfolio of U.S.-based renewable energy production assets (primarily wind and solar power generation facilities) with long-term power purchase agreements, support from its A-rated parent NEE (which also has a large equity stake in NEP), and the strong growth runway provided by drop down acquisitions from Energy Resources, the risk-adjusted total return profile at NEP is very appealing. It is extremely rare to find a stock with a 6%+ yield that is expected to grow at a double digit CAGR for the foreseeable future with the defensive characteristics that NEP enjoys.

High-Yield High-Growth Stock #2: Clearway Energy Stock (CWEN)(CWEN.A)

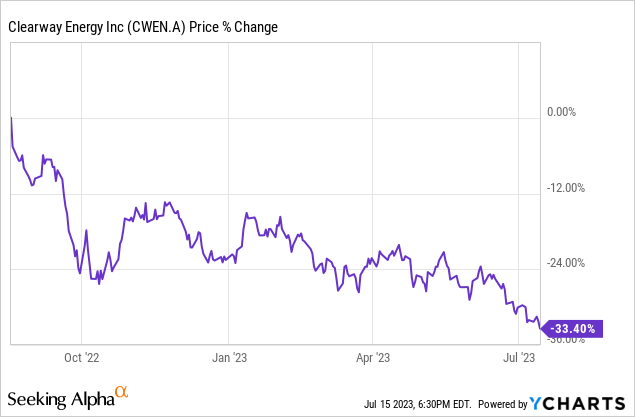

CWEN.A is another renewable energy producer that has taken a beating in recent months over cost of capital concerns:

As a result, its NTM dividend yield has reached a similar level of 6.1%, which is well above its five year average of 5.09%.

Moreover, like NEP, CWEN.A's management has reaffirmed its commitment to delivering very attractive dividend per share growth for the next several years. In this case, CWEN.A's management expects to deliver a 7-8% dividend per share CAGR through 2026. When combined with the 6.1% current yield, the total return looks quite appealing.

While CWEN.A's total return potential is not quite as attractive as NEP's (assuming each achieves management's guidance), CWEN.A has a bit lower risk for the following reasons:

- It faces less execution risk as NEP still has yet to sell its pipeline assets. In contrast, CWEN.A recently sold its thermal energy assets at an attractive valuation. This gave it ~$1.35 billion in net equity proceeds to reinvest in its growth pipeline. As a result, it has no external equity needs to fund its committed growth and next dropdowns since it can fully fund these projects with retained cash flow alongside its thermal divestiture proceeds. Moreover, it can opportunistically tap bond markets thanks to its over $550 million in available capacity on its revolving credit facility. This enables management to state on its latest investor presentation: "No external equity needed to meet DPS growth objectives through 2026 given Thermal proceeds/retained CAFD."

- Similar to NEP, it enjoys support from its owner-sponsor Clearway Group which in turn is owned by Global Infrastructure Partners and TotalEnergies (TTE), giving it access to attractive deal flow in the process. This helps to de-risk its growth profile in a manner that is somewhat similar to what NEP enjoys.

Like NEP, CWEN.A is also primarily owns U.S. assets, mitigating foreign exchange and geopolitical risks that some of its peers like Brookfield Renewable (BEP)(BEPC) and Atlantica Sustainable Infrastructure (AY) face.

Investor Takeaway

High yield and high growth are a rare combination. In CWEN.A and NEP, investors have access to 6.1% current yields and potential high single digit to low double digit dividend per share CAGRs for many years to come. Moreover, these businesses enjoy the support of strong sponsors who are feeding them drop downs. Last, but not least, they have clearly delineated plans for raising sufficient equity capital to fuel their growth ambitions while also benefiting from having well-located defensive asset portfolios. We rate both Strong Buys and are buying them hand-over-fist.

"like this" - Google News

July 17, 2023 at 07:00PM

https://ift.tt/v3x5Bug

There May Not Be A High-Yield High-Growth Opportunity Like This For Years - Seeking Alpha

"like this" - Google News

https://ift.tt/MVJFBky

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

No comments:

Post a Comment