ryasick

Co-produced by Austin Rogers.

Real estate investment trusts ("REITs") have become one of the most shunned asset classes on the public markets.

Professional and individual investors alike have dumped REIT shares as interest rates have surged higher, resulting in a scenario where most investors are significantly underweight REITs.

We think much of this shift has been driven by momentum rather than fundamentals. Today, REITs on average are well-positioned to handle higher interest rates, with leverage ratios of around 40% and weighted average debt maturities of around 7 years. They will not feel the pinch of high rates all at once, and rent growth will be able to offset rising interest costs.

Below, we make the case that REITs offer a phenomenal buying opportunity today that may soon disappear. A buying opportunity this attractive may not arise again for a long time.

The Buy Case For REITs Today

We know from firsthand experience that many individual investors hate REITs right now. Every time we publish an article making the case for REITs, we receive dozens of comments saying something to the tune of:

- "I wouldn't touch REITs right now"

- "Why would you buy a REIT when bonds yield just as much or more?"

- "I'm holding my money in 5%-yielding cash accounts until the real deals come"

- "REITs won't bottom until 2024 or 2025."

The confidence some commenters seem to have about when REIT stock prices will bottom is striking.

But the point in mentioning this is simply to show anecdotal evidence that individual investors are more bearish on REITs than they have been in a very long time. We interpret this as a contrarian buy signal. After all, if everyone who could be persuaded to sell their REIT holdings has already sold, who is left to sell?

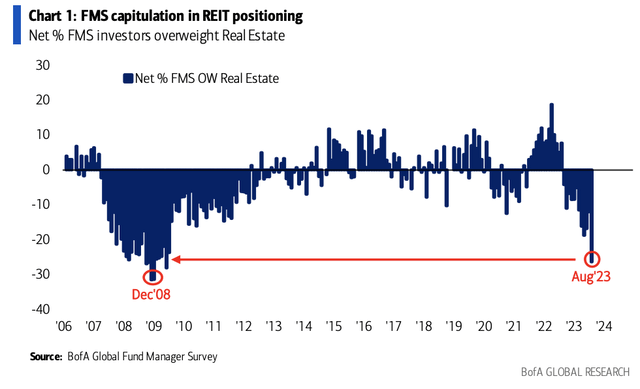

We find that professional money managers have exhibited the same pattern of increasingly underweighting REITs this year.

FT

The headlines often conflate "commercial real estate" with "office real estate," despite office making up less than 5% of the REIT index. This makes it seem as if fund managers have only sold office REITs lately. But in reality, fund managers are heavily underweight all REITs. They have categorically shunned the whole REIT sector.

As of August 2023, fund managers were the most underweight REITs since the Great Financial Crisis of 2008-2009.

BofA Fund Managers Survey

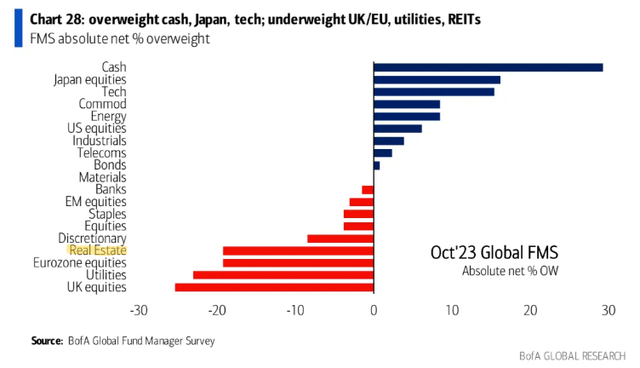

As of the October Bank of America Fund Manager Survey, the only U.S. stock sector that fund managers are more underweight than real estate/REITs is utilities (XLU).

BofA Fund Manager Survey

How much more bearish can money managers get on real estate?

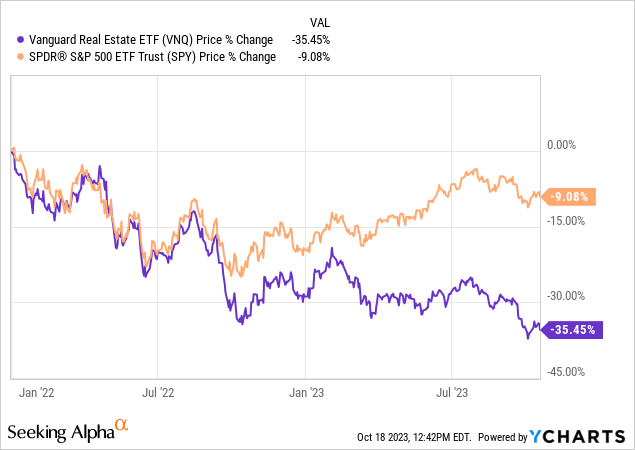

Some might think that there's plenty more downside in REIT stocks. After all, during the GFC, the REIT index as measured by the Vanguard Real Estate Index Fund ETF Shares (VNQ) fell by around 2/3rds from peak to trough. Today, the VNQ has dropped only about 35% peak to trough, compared to the S&P 500's (SP500) less than 10% decline from the peak to date.

Since the beginning of 2022, REITs have underperformed the broader market by 26 percentage points!

Why think that this underperformance is about to reverse?

Well, consider that REITs have traded like bond alternatives, selling off in tandem with bonds. If REITs drop because bond yields rise, then if bond yields fall, REITs should rise in value.

Why think bond yields are going to fall sometime in the foreseeable future?

Because the Fed's primary reason for holding rates this high (inflation) has already been tamed when properly measured.

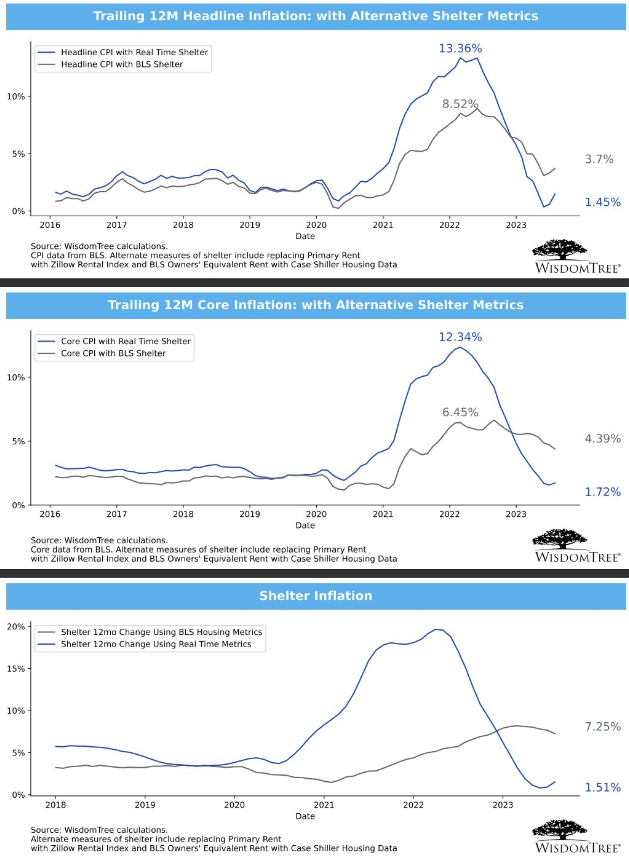

The single largest contributor to over 2% inflation rates today is the "shelter" component of inflation metrics, both the CPI and PCE. It is the largest component of the index by weighting (35% of the CPI and 40% of core PCE), and it lags real-time housing price changes by about a year.

As you can see in the charts below, when using real-time housing price measurements, inflation is already well below the Fed's 2% target.

Jason Schwartz via X

This information about shelter inflation is not widely known outside of economics and Wall Street circles, and thus the broader public maintains the faulty belief that "inflation is still too hot."

Using real-time changes in housing prices, inflation is actually lower than it was for most of the low-inflation period of the 2010s!

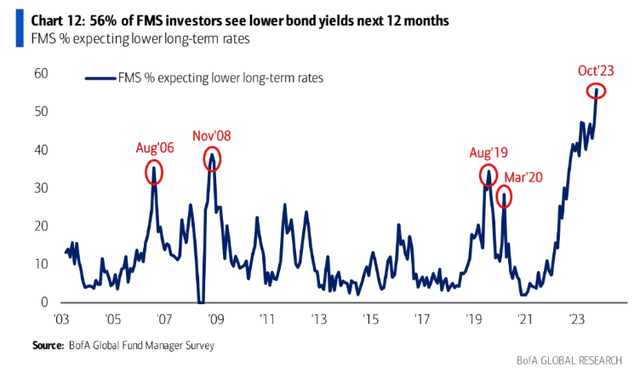

Perhaps this data, combined with the highest bond yields seen in 15 years, explains why more fund managers today expect bond yields to decline in the next 12 months than at any time in the last two decades.

BofA Fund Manager Survey

If the majority of fund managers are correct and bond yields do fall in the next 12 months, then REITs should rebound from their current depressed levels.

Two Examples of Opportunistic REIT Buys

We don't just tell others what to buy. We are real estate investors ourselves that invest in REITs with the mindset of a landlord. We buy and hold undervalued REITs with big upside and total returns prospects, and wait patiently until the market rewards us.

Here are a few examples of REITs we have recently purchased.

Agree Realty Corporation (ADC)

ADC owns a portfolio of some of the safest and most recession-resistant real estate in the entire public REIT space. The REIT targets single-tenant retail properties net leased on a long-term basis to the nation's 30 or so largest and strongest retailers.

ADC September Presentation

ADC's largest tenant industry is grocery at a bit over 10% of total rent with tenants like Walmart (WMT) and Target (TGT), followed by home improvement stores such as The Home Depot (HD) at about 9%, tire & auto services at almost 9%, and dollar stores at nearly 8%.

Over 2/3rds of ADC's tenants (67.9%, to be exact) are investment grade rated, and many of those that are not IG-rated are simply unrated while boasting IG-equivalent balance sheets. Examples of this category include Hobby Lobby (zero debt), Publix, and Aldi.

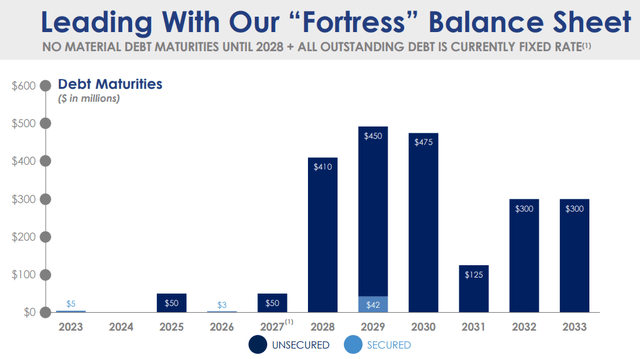

Perhaps best of all, ADC enjoys top-notch balance sheet strength, with debt to enterprise value of 25% and very little debt maturing until 2028.

ADC September Presentation

The market is underappreciating this balance sheet and portfolio strength, seemingly treating ADC as nothing more than a bond proxy. The REIT has sold off more than 20% YTD.

But ADC is much more attractive than a bond. It pays a monthly dividend yielding 5.3%, and the REIT has a decade-plus track record of increasing that dividend at a growth rate averaging 6%.

The yield + the growth should be enough to deliver double-digit annual total returns going forward, and we expect another 30% of upside on top of that.

Tricon Residential Inc. (TCN)

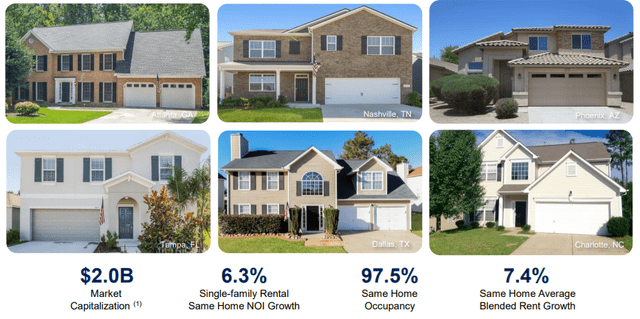

TCN owns a portfolio of around 37,000 single-family rentals concentrated overwhelmingly in fast-growing Sunbelt states like Texas, Florida, and North Carolina.

TCN October Presentation

This SFR portfolio enjoys high occupancy and rent growth of over 7% as of Q2 2023, demonstrating continued demand for single-family homes from renters. And with homebuying affordability declining to multi-decade lows amid rising home prices and mortgage rates, many would-be homeowners will have to remain renters for the foreseeable future.

In fact, according to TCN, the cost of buying a starter home with a mortgage is currently over $1,000 more on a monthly basis than renting the same home.

Another point in TCN's favor is the fact that the large Millennial generation is aging into the prime single-family home years. With affordability out of reach for most, many of these Millennials will choose to rent instead. And once someone moves into an SFR, they typically stay for 3-5 years, instead of the 2-year average stay at an apartment.

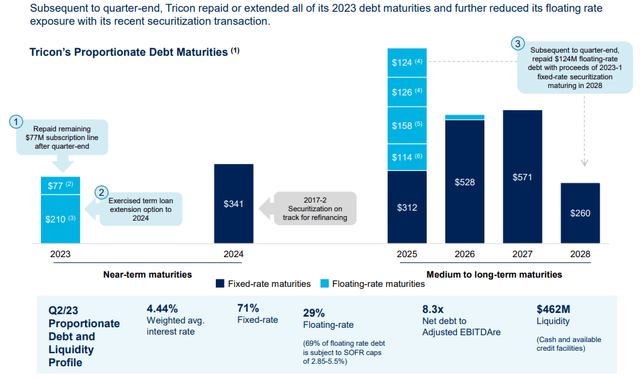

TCN does have a bit more debt than its peers at 8.3x net debt to EBITDA as of Q2 2023, but its loan-to-value ratio is only about 40%, and the REIT has actively taken steps to refinance upcoming debt maturities.

TCN October Presentation

Moreover, TCN has several joint venture partnerships in which it serves as the general partner in order to scale up its portfolio faster. This expanding JV platform diversifies TCN's revenue streams into asset management, collecting fees to manage thousands of homes in each JV portfolio.

Recently, activist REIT investor Land and Buildings pitched TCN as an attractive long idea, calling it "substantially undervalued" and asserting that the REIT has ~65% upside to net asset value.

While you wait for that upside, TCN pays a dividend yielding nearly 4%, meaningfully higher than its peer's yields that are under 3%.

Bottom Line

There are lots of attractive buying opportunities in the realm of REITs right now. The two highlighted above are just a few examples.

We think that the investor bearishness on REITs is close to its peak level, which means that REITs probably have far more upside than downside potential at their current level.

We are happily taking advantage of these buying opportunities while they last.

"like this" - Google News

November 04, 2023 at 07:05PM

https://ift.tt/TUyQYRS

There May Not Be Another Chance Like This For REITs In A Decade - Seeking Alpha

"like this" - Google News

https://ift.tt/Urf3jpC

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

No comments:

Post a Comment